A 501(c)(3) Public Charity

A 501(c)(3) Public Charity

OUR MISSION

Adagio Institute’s mission is to define the standard for producing the world’s most rigorously trained theoretical physicists and conduct pioneering in-house econophysics research through a unified mathematical framework of physical law, establishing a standard of academic excellence capable of advancing the frontiers of knowledge and mastering the dynamics of the world's most complex systems.

Adagio Institute’s mission is to define the standard for producing the world’s most rigorously trained theoretical physicists and conduct pioneering in-house econophysics research through a unified mathematical framework of physical law, establishing a standard of academic excellence capable of advancing the frontiers of knowledge and mastering the dynamics of the world's most complex systems.

Our Research

The Intellectual Foundations (Core Research & Applications)

The Standand Model of Complex Economic Systems

Mathematical econophysics paper introducing a unified framework that integrates signal processing, operator theory, and Bayesian inference to model financial markets with empirical rigor.

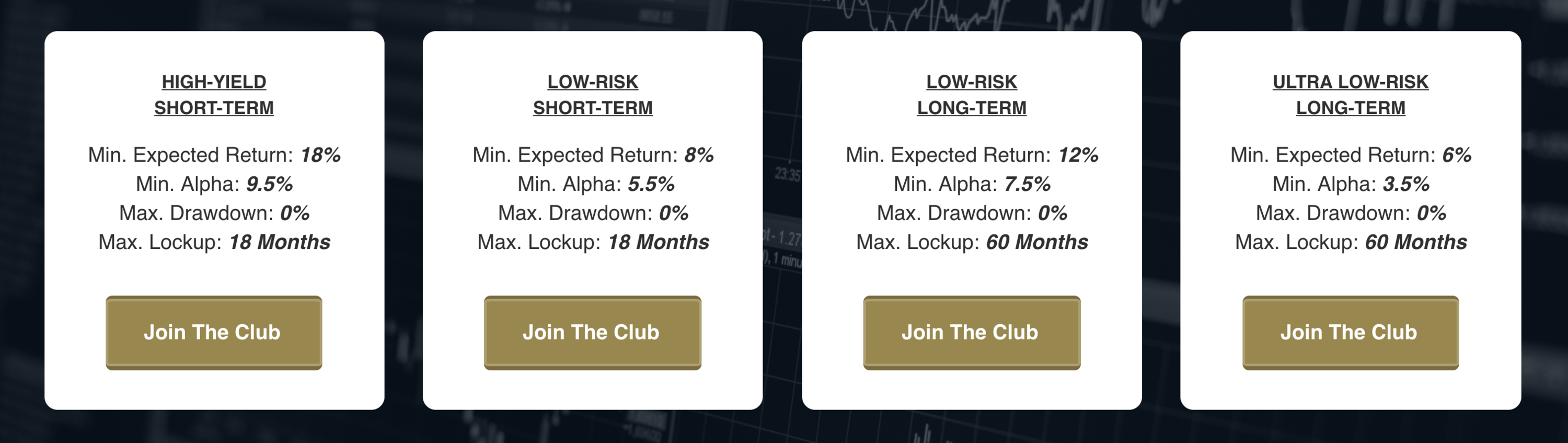

Adagio Group

Mathematical physics operates on first principles and empirical proof; institutional finance largely operates on consensus and convention. Adagio Group was founded to apply the discipline of the former to the domain of the latter via OCIO relationships with family offices and endowments.

The Institutional Framework

Academic Programs

Degree Programs

PhD in Mathematical Physics with Concentration in Statistical Quantum Mechanics

A doctoral accreditation standard designed to produce the world's most rigorously trained theoretical physicists. The core mission is to cultivate a Penrose-level mathematical mastery of physical law, understood not as a set of empirical rules but as a single, unified mathematical structure. The graduate curriculum is uncompromising in its rigor, guiding students from the symplectic geometry of classical mechanics and the differential geometry of field theories to the C*-algebraic formalism of quantum and statistical mechanics. The objective is to produce physicists with a first-principles command of physical law that surpasses that of the world's top academic programs. We recognize, however, that the traditional academic path is not the sole ambition of every brilliant physicist. For those money-motivated students disinclined towards a purely academic trajectory, we have created the path for them to optimally monetize their expertise…

Research Initiatives

Funded Research Program

A competitive program offering grants to external researchers whose work aligns with the Institute's core mission to advance the foundations of mathematical econophysics.

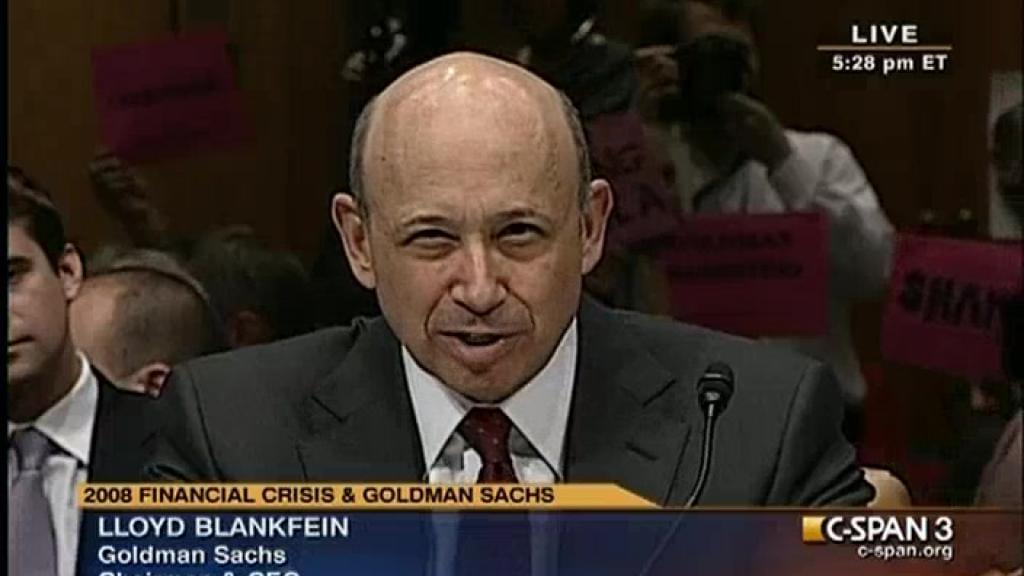

THE DIRECTORS

Benjamin D. Summers

Executive Director

Ben is the founder and managing director of Adagio Group, where he has built an innovative institutional OCIO model grounded in his transdisciplinary research in financial mathematics, econophysics, and financial engineering. This first-principles framework provides the quantitative engine for the firm's portfolio management and the analytical foundation for its comprehensive services—from investment policy development to robust, data-driven governance—for the family office and endowment space.

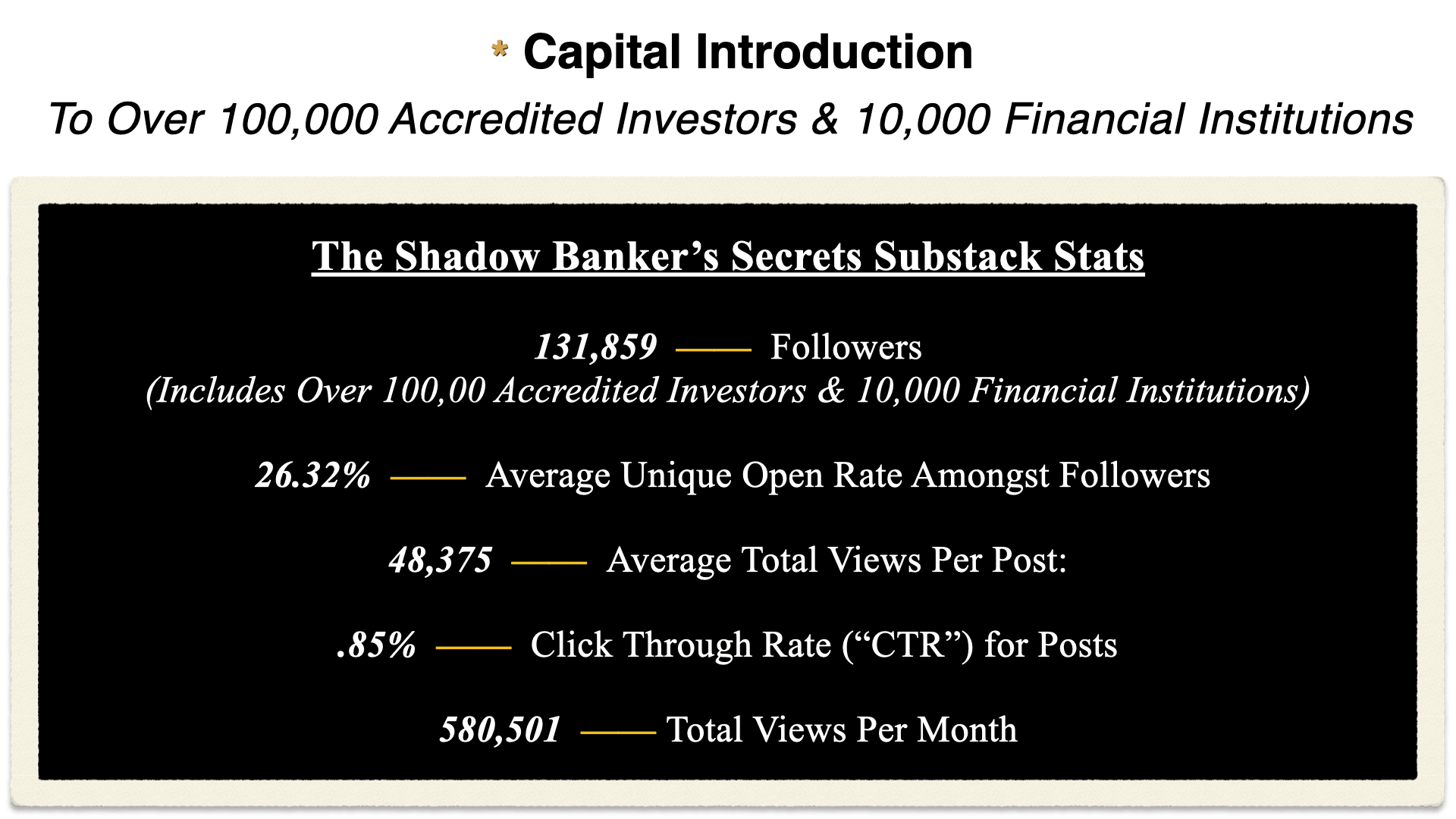

Ben’s non-traditional path, including careers as a professional athlete with the San Diego Padres and an executive in global energy services, provides a differentiated perspective on discipline, risk, and strategic decision-making. He holds a BS in Physics from LSU with a second discipline concentration in Music and is completing his PhD by Published Works. A member of the Forbes Finance Council, Ben is also the author of the #1 bestseller, The Shadow Banker's Secrets: Investment Banking for Alternatives.

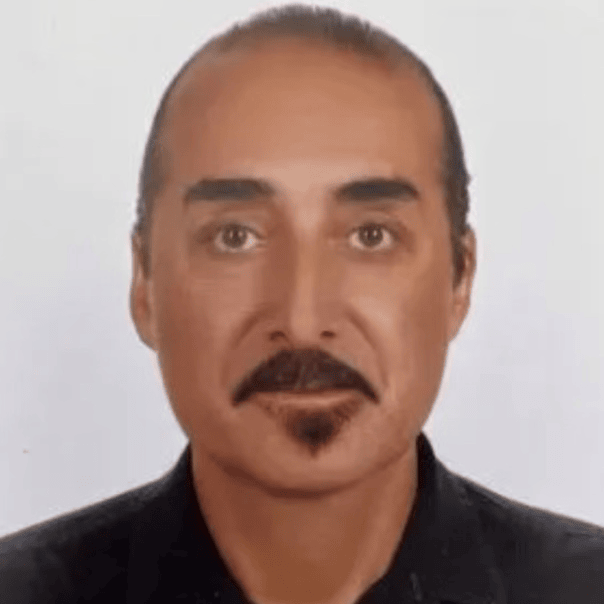

Dr. Ezequiel F. Boero Serra

Director - Theoretical & Computational Physics

Ezequiel leads advanced research and development in mathematical and physical modeling. He also serves as an Adjoint Professor in the Department of General Relativity and Gravitation at FaMAF, National University of Córdoba (“UNC”), Argentina. His academic work integrates rigorous theoretical frameworks with computational methodologies, supporting the institute’s transdisciplinary scientific initiatives.

In addition to his academic appointments, Ezequiel has accumulated more than fifteen years of independent research experience and over seven years as a scientific consultant to the private sector, bridging the gap between theoretical insight and real-world problem-solving, fostering collaboration between academia, research institutes, and industry.

Ezequiel received his Ph.D. in Theoretical Physics, with a research focus on general relativity, cosmology, and astrophysics. His expertise spans mathematical physics, numerical methods, scientific modeling, statistical analysis, and data interpretation. He has led and contributed to diverse international research projects, with results published in leading Q1 peer-reviewed journals in the fields of cosmology and astrophysics.

Dr. Kurtay Ogunc

Director - Asset Management

Kurtay is responsible for academic initiatives under Adagio Institute providing senior guidance on the firm's research and institutional initiatives. He is also the Director of Undergraduate Studies & Research, Director of the Asset Management Academy, and Director of the Quantitative Finance Club in the department of finance at LSU.

In addition to his academic career, Kurtay has served in the public and private sectors over the last three decades, most recently as the Senior Investment Officer for Risk Management and Asset Allocation in the Mayor’s Office for Pensions and Investments at the New York City Retirement System. Additionally, Kurtay served as the first investment manager for the LSU endowment.

Kurtay received his PhD in Decision Sciences (Asset Management, Stochastic Processes and Econometrics) and Master of Applied Statistics (Binary Choice Models and Bayesian Theory) from LSU and his MBA in Finance from Western Michigan University.

PAPERS

The Standard Model of Complex Economic Systems [WORKING PAPER]

March 2025

(This working paper presents the comprehensive theoretical and empirical framework underlying Adagio Group's successful investment strategies, now being transitioned to academic publication. Components of this framework are being prepared for submission to peer-reviewed journals.)

This paper introduces a comprehensive theoretical framework termed ”The Standard Model of Complex Economic Systems” that bridges econophysics, signal processing, and portfolio theory using Hilbert space methods. We develop a unified approach that integrates fundamental analysis with sophisticated quantitative methods, applying Bayesian inference in function spaces to signals extracted from spectral analysis, wavelet decomposition, and operator-theoretic analysis of financial time series. The primary objective is to optimize the Omega ratio for leveraged liquid assets that have passed specific fundamental screening criteria. This dual-methodology approach addresses a significant gap in current practice: fundamental analysis establishes intrinsic value baselines while Hilbert space methods identify market signals that enable predictive modeling of period total returns. We introduce the Summers Total Risk-Adjusted Performance Measure (Summers Measure) with functional extensions that provide improved interpretability while preserving higher-moment sensitivity. Empirical testing demonstrates that our approach significantly outperforms traditional optimization techniques, particularly during market regime transitions and periods of high volatility. The framework contributes to the theoretical understanding of financial markets as complex adaptive systems while offering practical applications for investment management. By providing a physically interpretable model of market dynamics grounded in functional analysis, this paper establishes a foundation for a new paradigm in quantitative finance.

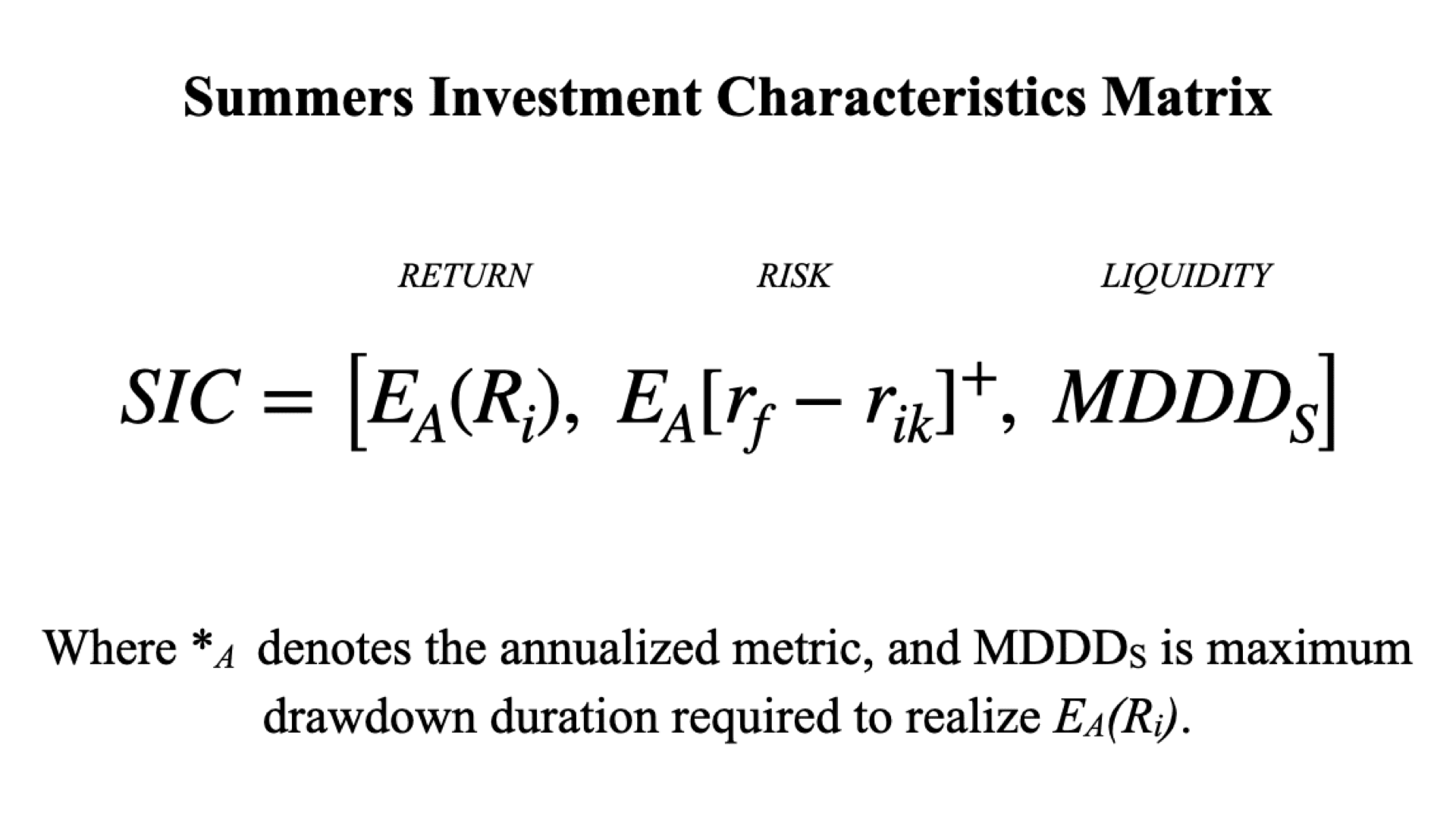

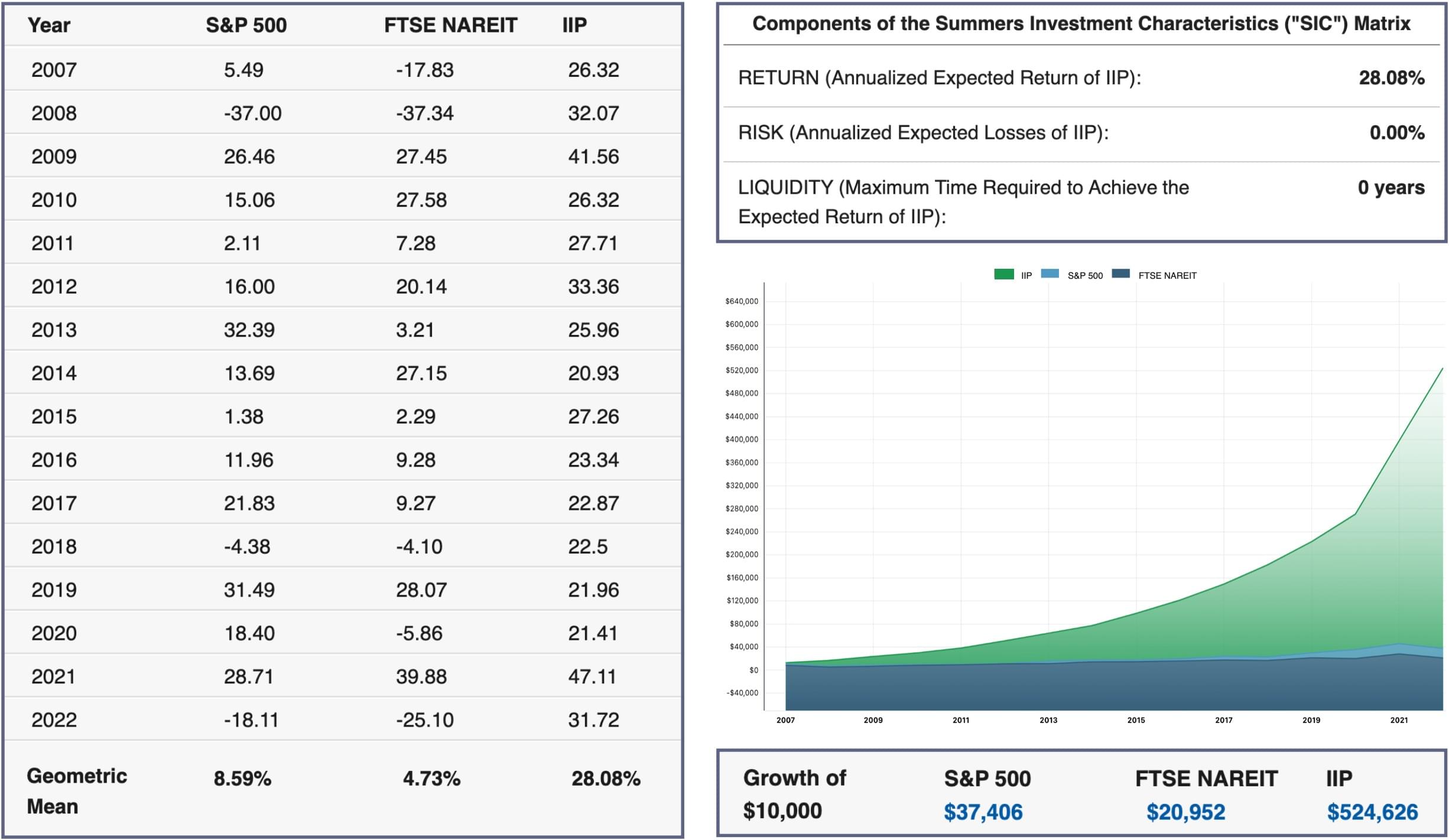

An Intuitive True Total Risk-Adjusted Performance Measure and Characteristics Matrix

January 2023

Keating and Shadwick’s Omega ratio captures all statistical moments of return distributions but has practical limitations with respect to portfolio optimization. Kapsos et al. simplified the Omega ratio into an expression with better practical application, but its focus as a portfolio optimization tool represents a trade-off with respect to absolute risk-adjusted performance measurement. First, we've transformed the Kapsos form of the Omega ratio in an analogous manner to what Modigliani did with the Sharpe ratio to create an intuitive percentage output scaled against the market. Second, we’ve deconstructed the Kapsos form of Omega to create a 3 x 1 matrix that measures and intuitively communicates the three fundamental characteristics that define an investment: risk, return, and liquidity.

Be a Better Fiduciary: Private Structured Products & Quantitative Risk Analytics for Financial Advisors

February 2018

(This paper details the core philosophy behind our use of bespoke private structured products. While originally framed for financial advisors, its central argument on the duties of a modern fiduciary is directly applicable to institutional allocators. It establishes the 'why' for this critical component of our platform. The specific 'how'—the proprietary engineering of these solutions—is now governed by the more advanced frameworks detailed in our core research, such as the Summers Measure and the SIC Matrix.)

Most financial advisors adhere to a very traditional asset allocation model built entirely upon public securities. Outside of the fact that a set of relatively vague, qualitative criteria govern the literal value of their clients’ life work, the substance upon which those models are predicated is a set of assets completely dependent upon schizophrenic secondary markets...

Investment Banking for Private Real Estate Operators

June 2017

Investment banks are intermediaries that, amongst many other functions, help typically large companies raise capital by advising on and underwriting new securities issues. To prepare for a new issue of securities, investment banks first advise their clients on considerations such as capital structure (how much debt vs. equity should be issued; what types of equity and debt should be issued, etc.), the strategic use of other financial instruments (such as warrants), and...

Investment Clubs: Gain the Exclusive Access of the Top 1%

May 2017

There is a little-known solution that can afford non-accredited investors the opportunity to participate in the exclusive securities offerings of hedge funds and invest like the top one percent: the investment club. An investment club is a business entity structured as either a general partnership or LLC in which all members (owners) are also managers who participate by vote in determining the investment decisions of the club; because all owners actively participate...

Constructing Alpha: An Introduction to the Fundamentals of Risk

April 2017

Every investor — from the guy who bets on physical currency by hiding it under his mattress to Ray Dalio — is concerned with risk. Somewhat surprisingly, despite the fact that the vast majority of people are risk averse, very few have any idea what risk actually means or how to measure it… this group includes many, if not most, financial professionals. Ironically, despite retail investors’ often stated aversion to risk, they tend to solely focus on the projected return...

From Wall Street to Main Street

July 2016

Most real estate investors face the nearly impossible task of competing for the few quality deals in their market against tens, if not hundreds, of deep-pocketed, well-connected and established investors already there. To survive, new and undercapitalized investors are forced to work many fruitless hours blindly mailing, calling, driving and knocking on random doors to find whatever scraps may be left over. After all this effort, in the rare instance a good deal is finally secured...

Introduction to Options in Real Estate

January 2015

One of most prolific and powerful tools of “creative” finance in real estate is the lease-option, but this tool represents only the proverbial tip of the iceberg when it comes to the most powerful breed of derivatives in the investing world, options. There are two basic types of options: the call option (or “call”) and the put option (or “put”). A call is what is utilized in the traditional lease-option; the put, on the other hand, is virtually unheard of in the world or real estate. An option...

Determining Equilibrium Value for Residential Real Estate

March 2013

(This paper serves as a foundational case study in the Adagio methodology. It demonstrates how we dismantle a conventional, narrative-based valuation model ("comparable sales") and replace it with a rigorous, first-principles framework derived from corporate finance. The subject is real estate; the principle is universal.)

One of the most pervasive challenges facing the residential real estate market is the determination of property values. As a result of TARP and other federal subsidies to institutional mortgage lenders, in addition to administrative incompetence, the foreclosure pipeline has been clogged. The expected glut of inventory resulting from the mortgage and financial crisis has yet to materialize, and correspondingly, prices have been lifted by artificially limited supply...

Deciphering Monetary Policy as a Means to Beat the Market

October 2012

(This paper details the first-principles critique of the post-1971 monetary order that serves as the foundation of our institutional worldview. While our tactical implementation has since evolved into a comprehensive OCIO platform, the core diagnosis of systemic risk articulated in this document remains our unwavering guide.)

Monetary policy and its effect on the markets can often seem as an impossibly complex, if not opaque dynamic. The market obviously responds, and most often in a seemingly positive manner, to the actions taken by the Federal Reserve System and statements by its chairman, Ben Bernanke… but how and why, and what are the less obvious effects of a centralized monetary system...

ADAGIO INSTITUTE, INC. © 2025 All Rights Reserved

5100 Westheimer Rd, Ste 115 • Houston, Texas 77056